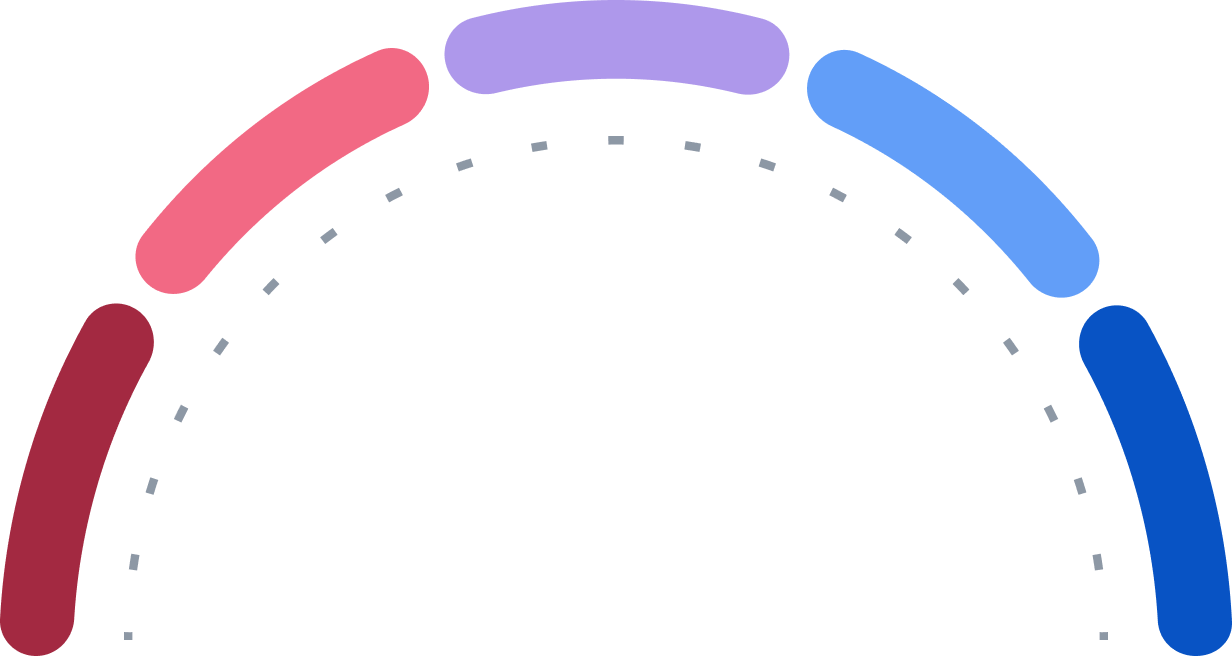

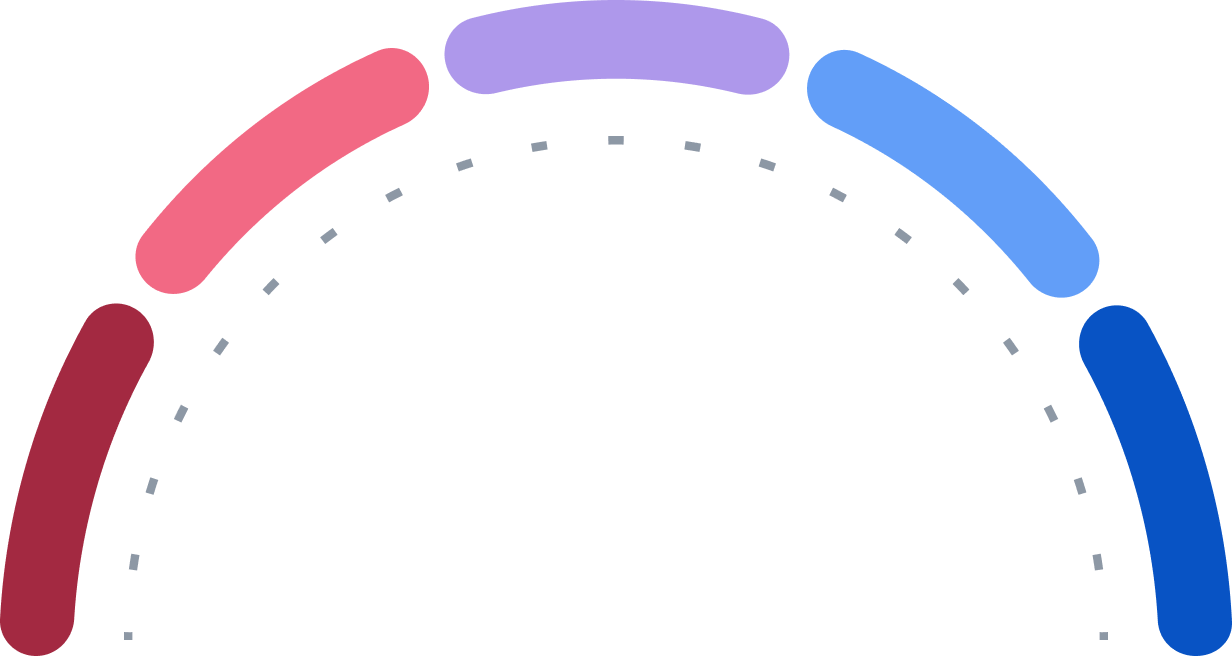

Hold

Strong Buy

Buy

Hold

Sell

Strong Sell

1

4

14

1

0

| Exchange | Ticker | Currency | Last Trade | Price | Daily Change |

|---|---|---|---|---|---|

UTC |

NVSEF

|

USD

|

27.01.2026 19:23

|

152,00 USD

| -2,85 USD

-1,84 %

|

Frankfurt |

NOT.F

|

EUR

|

27.01.2026 18:17

|

126,94 EUR

| 1,24 EUR

+0,99 %

|

SIX |

NOVN.SW

|

CHF

|

27.01.2026 16:02

|

117,00 CHF

| 1,12 CHF

+0,97 %

|

Hamburg |

NAGNAS67.HAMB

|

EUR

|

27.01.2026 07:01

|

127,38 EUR

| 1,68 EUR

+1,34 %

|

Hannover |

NAGNAS67.HANB

|

EUR

|

27.01.2026 07:01

|

127,38 EUR

| 1,68 EUR

+1,34 %

|

Quotrix |

NAGNAS67.DUSD

|

EUR

|

27.01.2026 06:27

|

126,18 EUR

| 0,48 EUR

+0,38 %

|

Düsseldorf |

NAGNAS67.DUSB

|

EUR

|

26.01.2026 18:30

|

125,92 EUR

| 1,64 EUR

+1,32 %

|

The following funds have invested in NOVARTIS AG:

Fund | Vol. in million 5.334,00 | Percentage (%) 12,22 % |

Fund | Vol. in million 25.030,08 | Percentage (%) 8,50 % |

Fund | Vol. in million 4.555,23 | Percentage (%) 4,20 % |

Fund | Vol. in million 3.555,03 | Percentage (%) 4,17 % |

Fund | Vol. in million 98.829,17 | Percentage (%) 3,28 % |

SIX

SIX

| Date | Split |

|---|---|

| 04.10.2023 | 6:5 |

| Name | Symbol |

|---|---|

| Over The Counter | NVSEF |

| Düsseldorf | NAGNAS67.DUSB |

| Frankfurt | NOT.F |

| Hamburg | NAGNAS67.HAMB |

| Hannover | NAGNAS67.HANB |

| Quotrix | NAGNAS67.DUSD |

| SIX | NOVN.SW |

| XETRA | NOT.DE |