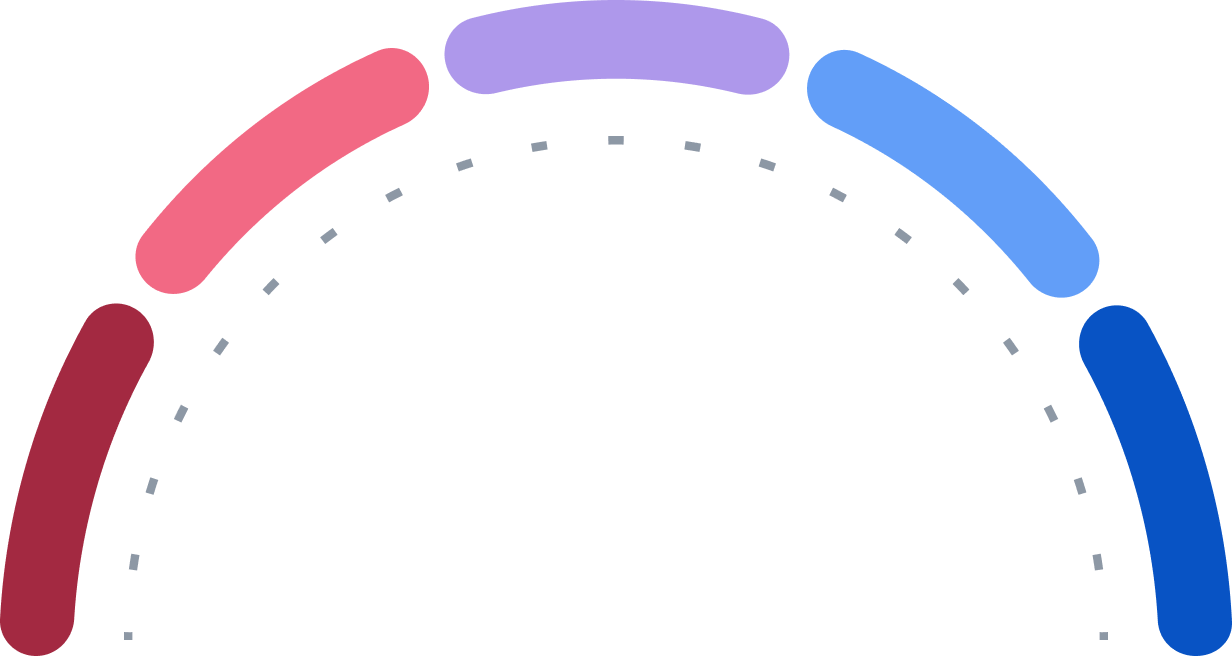

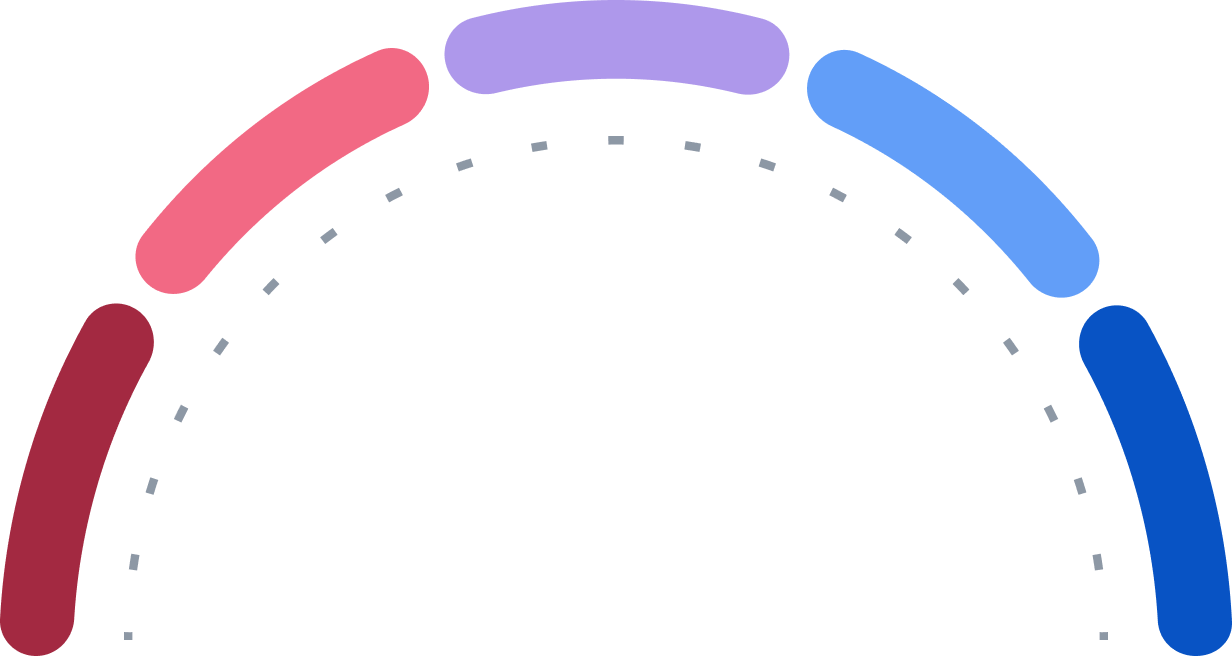

Buy

Strong Buy

Buy

Hold

Sell

Strong Sell

1

31

4

0

0

| Exchange | Ticker | Currency | Last Trade | Price | Daily Change |

|---|---|---|---|---|---|

NYSE |

ICE

|

USD

|

28.01.2026 00:43

|

173,28 USD

| 0,00 USD |

Frankfurt |

IC2.F

|

EUR

|

27.01.2026 20:50

|

143,90 EUR

| -2,90 EUR

-1,98 %

|

XETRA |

IC2.DE

|

EUR

|

27.01.2026 16:14

|

145,28 EUR

| -1,52 EUR

-1,04 %

|

London |

0JC3.L

|

USD

|

27.01.2026 15:45

|

173,59 USD

| -1,51 USD

-0,87 %

|

Hannover |

IEIRSD49.HANB

|

EUR

|

27.01.2026 07:01

|

147,30 EUR

| 0,50 EUR

+0,34 %

|

Quotrix |

IEIRSD49.DUSD

|

EUR

|

27.01.2026 06:27

|

147,92 EUR

| 1,12 EUR

+0,76 %

|

Düsseldorf |

IEIRSD49.DUSB

|

EUR

|

26.01.2026 18:31

|

146,84 EUR

| -0,96 EUR

-0,65 %

|

Hamburg |

IEIRSD49.HAMB

|

EUR

|

26.01.2026 09:23

|

145,46 EUR

| -2,34 EUR

-1,58 %

|

The following funds have invested in INTERCONTINENTAL EXCHANGE INC:

Fund | Vol. in million 42,03 | Percentage (%) 0,83 % |

Fund | Vol. in million 12.017,14 | Percentage (%) 0,69 % |

Fund | Vol. in million 176,49 | Percentage (%) 0,31 % |

Fund | Vol. in million 404,46 | Percentage (%) 0,31 % |

Fund | Vol. in million 7,35 | Percentage (%) 0,27 % |

NYSE

NYSE

| Ex-Date | Dividend per Share |

|---|---|

| 16.12.2025 | 0,48 USD |

| 16.09.2025 | 0,48 USD |

| 13.06.2025 | 0,48 USD |

| 17.03.2025 | 0,48 USD |

| 16.12.2024 | 0,45 USD |

| 16.09.2024 | 0,45 USD |

| 13.06.2024 | 0,45 USD |

| 14.03.2024 | 0,45 USD |

| 14.09.2023 | 0,42 USD |

| 14.06.2023 | 0,42 USD |

| Date | Split |

|---|---|

| 04.11.2016 | 5:1 |

| Name | Symbol |

|---|---|

| Düsseldorf | IEIRSD49.DUSB |

| Frankfurt | IC2.F |

| Hamburg | IEIRSD49.HAMB |

| Hannover | IEIRSD49.HANB |

| London | 0JC3.L |

| NYSE | ICE |

| Quotrix | IEIRSD49.DUSD |

| XETRA | IC2.DE |