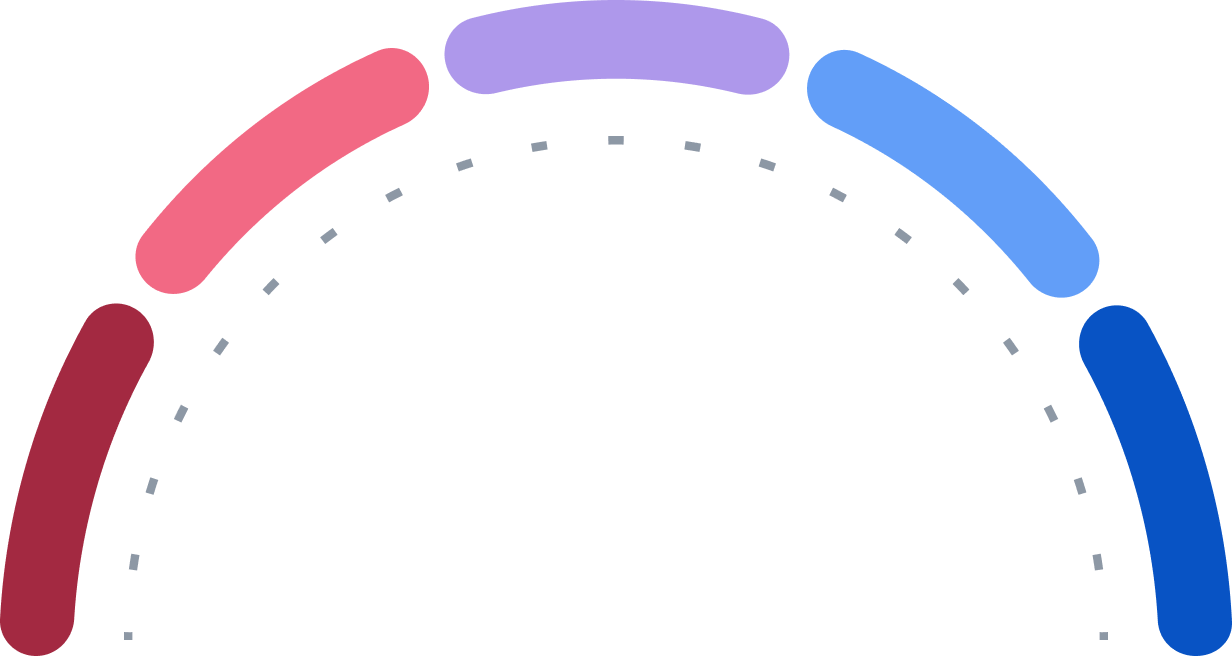

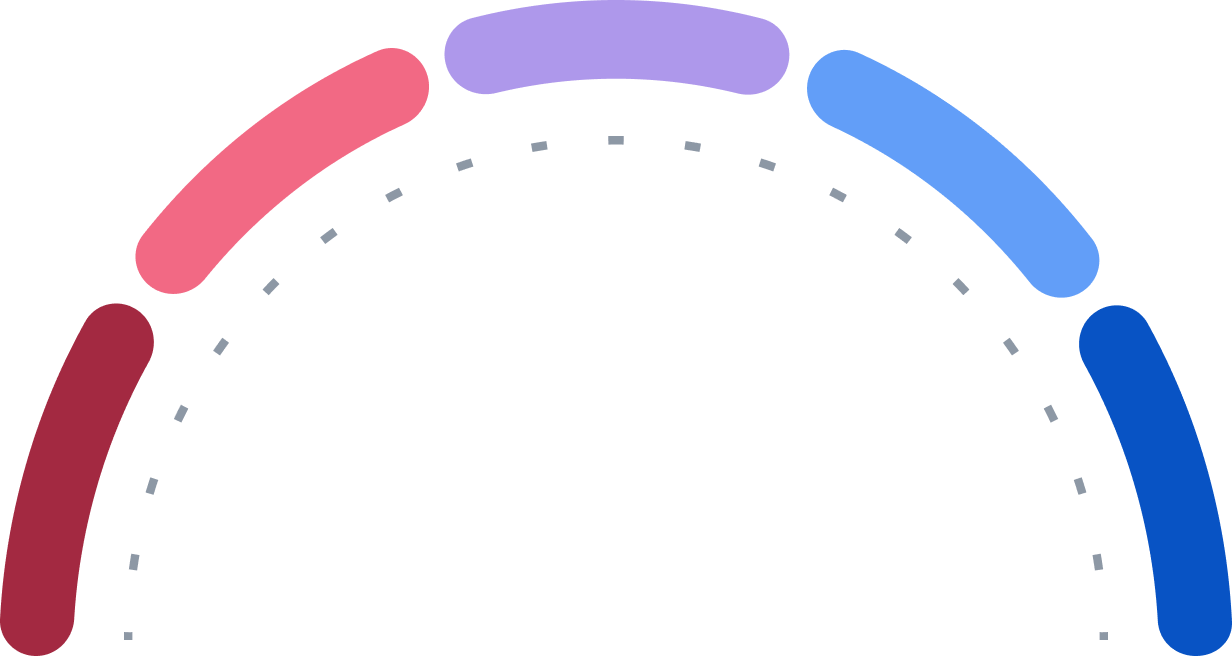

Comprar

Compra Fuerte

Comprar

Mantener

Vender

Venta Fuerte

1

14

6

0

0

| Bolsa | Ticker | Moneda | Última operación | Precio | Variación diaria |

|---|---|---|---|---|---|

NYSE |

STWD

|

USD

|

19.12.2025 22:42

|

18,47 USD

| 0,03 USD

+0,16 %

|

Frankfurt |

VSP.F

|

EUR

|

19.12.2025 20:55

|

15,72 EUR

| -0,03 EUR

-0,19 %

|

Quotrix |

SPTIRS52.DUSD

|

EUR

|

19.12.2025 06:27

|

15,71 EUR

| -0,04 EUR

-0,29 %

|

Düsseldorf |

SPTIRS52.DUSB

|

EUR

|

18.12.2025 15:00

|

15,76 EUR

| 0,08 EUR

+0,51 %

|

Hamburg |

SPTIRS52.HAMB

|

EUR

|

18.12.2025 07:09

|

15,80 EUR

| 0,12 EUR

+0,73 %

|

London |

0L9F.L

|

USD

|

08.12.2025 19:02

|

18,34 USD

| 0,10 USD

+0,55 %

|

NYSE

NYSE

| Fecha ex-dividendo | Dividendo por acción |

|---|---|

| 30.09.2025 | 0,48 USD |

| 30.06.2025 | 0,48 USD |

| 31.03.2025 | 0,48 USD |

| 31.12.2024 | 0,48 USD |

| 30.09.2024 | 0,48 USD |

| 28.06.2024 | 0,48 USD |

| 27.03.2024 | 0,48 USD |

| 28.12.2023 | 0,48 USD |

| 28.09.2023 | 0,48 USD |

| 29.06.2023 | 0,48 USD |

| Fecha | Split |

|---|---|

| 03.02.2014 | 12402:10000 |

| Nombre | Símbolo |

|---|---|

| Düsseldorf | SPTIRS52.DUSB |

| Frankfurt | VSP.F |

| Hamburg | SPTIRS52.HAMB |

| London | 0L9F.L |

| NYSE | STWD |

| Quotrix | SPTIRS52.DUSD |