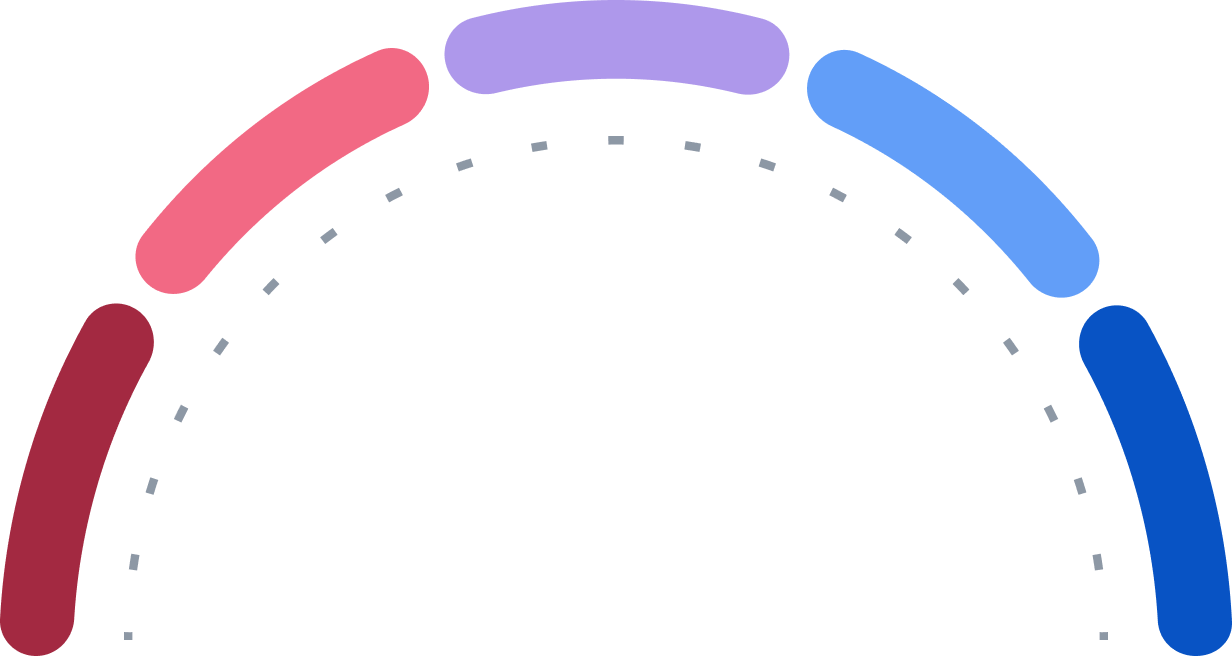

Comprar

Compra Fuerte

Comprar

Mantener

Vender

Venta Fuerte

0

23

3

0

0

| Bolsa | Ticker | Moneda | Última operación | Precio | Variación diaria |

|---|---|---|---|---|---|

NYSE |

KKR

|

USD

|

26.01.2026 22:39

|

118,11 USD

| -3,14 USD

-2,59 %

|

Quotrix |

KKRCIC45.DUSD

|

EUR

|

26.01.2026 19:48

|

99,99 EUR

| -2,53 EUR

-2,47 %

|

London |

0Z1W.L

|

USD

|

26.01.2026 16:11

|

120,71 USD

| -0,54 USD

-0,45 %

|

Frankfurt |

KR51.F

|

EUR

|

26.01.2026 15:52

|

99,33 EUR

| -3,19 EUR

-3,11 %

|

Hamburg |

KKRCIC45.HAMB

|

EUR

|

23.01.2026 07:09

|

105,46 EUR

| 0,22 EUR

+0,21 %

|

Düsseldorf |

KKRCIC45.DUSB

|

EUR

|

22.01.2026 18:30

|

106,02 EUR

| -0,14 EUR

-0,13 %

|

Los siguientes fondos han invertido en KKR + CO INC:

Fondo | Vol. en millones 12.505,87 | Porcentaje (%) 0,80 % |

Fondo | Vol. en millones 67,19 | Porcentaje (%) 0,52 % |

Fondo | Vol. en millones 20,51 | Porcentaje (%) 0,41 % |

Fondo | Vol. en millones 321,80 | Porcentaje (%) 0,08 % |

Fondo | Vol. en millones 3.320,47 | Porcentaje (%) 0,08 % |

NYSE

NYSE

| Fecha ex-dividendo | Dividendo por acción |

|---|---|

| 17.11.2025 | 0,19 USD |

| 11.08.2025 | 0,19 USD |

| 12.05.2025 | 0,19 USD |

| 14.02.2025 | 0,18 USD |

| 04.11.2024 | 0,18 USD |

| 12.08.2024 | 0,18 USD |

| 10.05.2024 | 0,18 USD |

| 15.02.2024 | 0,17 USD |

| 16.11.2023 | 0,17 USD |

| 16.08.2023 | 0,17 USD |

| Nombre | Símbolo |

|---|---|

| Düsseldorf | KKRCIC45.DUSB |

| Frankfurt | KR51.F |

| Hamburg | KKRCIC45.HAMB |

| London | 0Z1W.L |

| NYSE | KKR |

| Quotrix | KKRCIC45.DUSD |