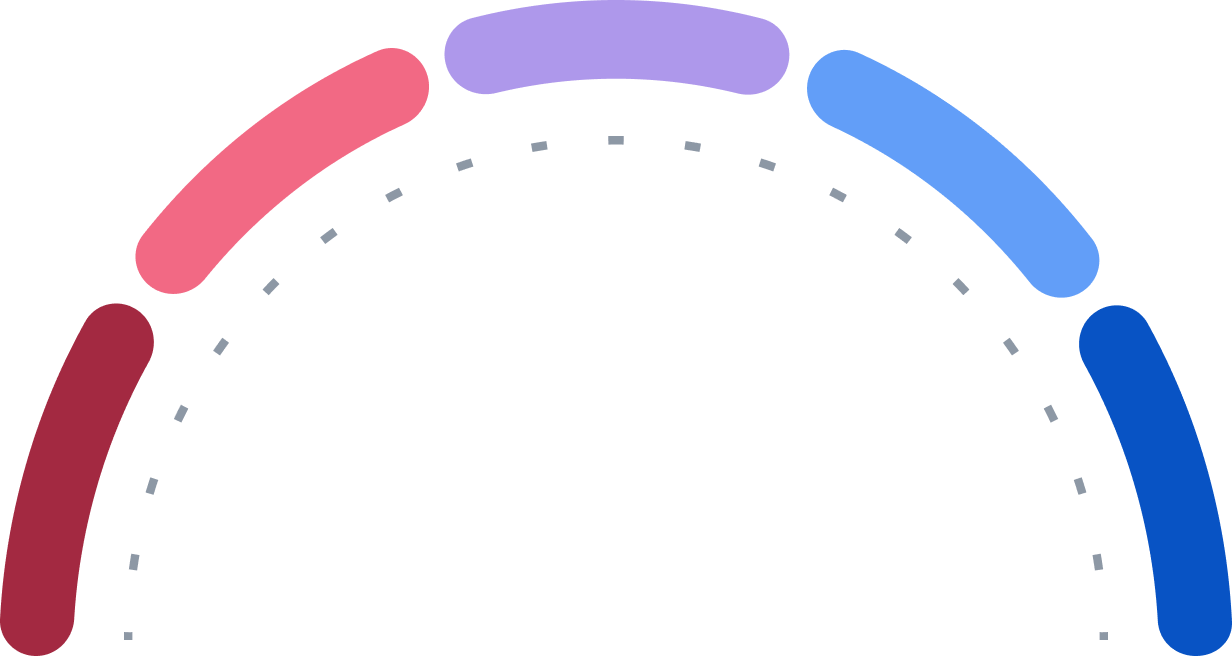

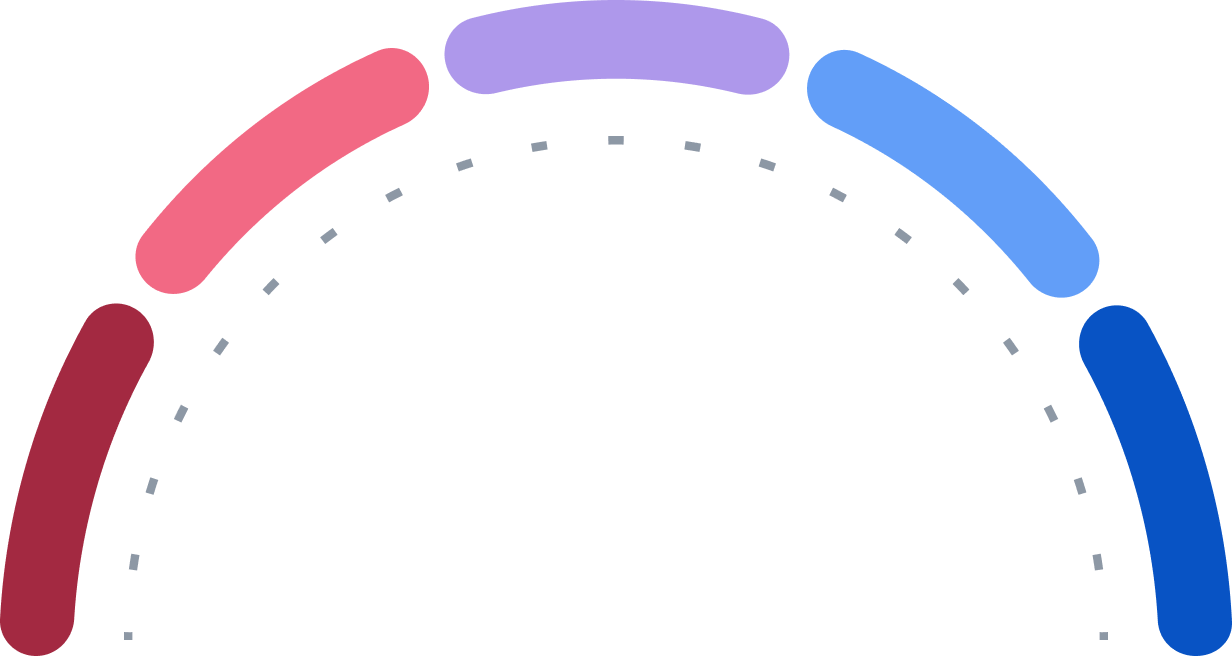

Hold

Strong Buy

Buy

Hold

Sell

Strong Sell

0

1

10

1

0

| Exchange | Ticker | Currency | Last Trade | Price | Daily Change |

|---|---|---|---|---|---|

NYSE |

TPVG

|

USD

|

04.11.2025 20:33

|

5,46 USD

| -0,10 USD

-1,80 %

|

NYSE

NYSE

| Ex-Date | Dividend per Share |

|---|---|

| 16.09.2025 | 0,23 USD |

| 16.06.2025 | 0,30 USD |

| 17.03.2025 | 0,30 USD |

| 13.12.2024 | 0,30 USD |

| 16.09.2024 | 0,30 USD |

| 14.06.2024 | 0,40 USD |

| 13.03.2024 | 0,40 USD |

| 14.12.2023 | 0,40 USD |

| 14.09.2023 | 0,40 USD |

| 14.06.2023 | 0,40 USD |

| Name | Symbol |

|---|---|

| Frankfurt | 6JS.F |

| NYSE | TPVG |