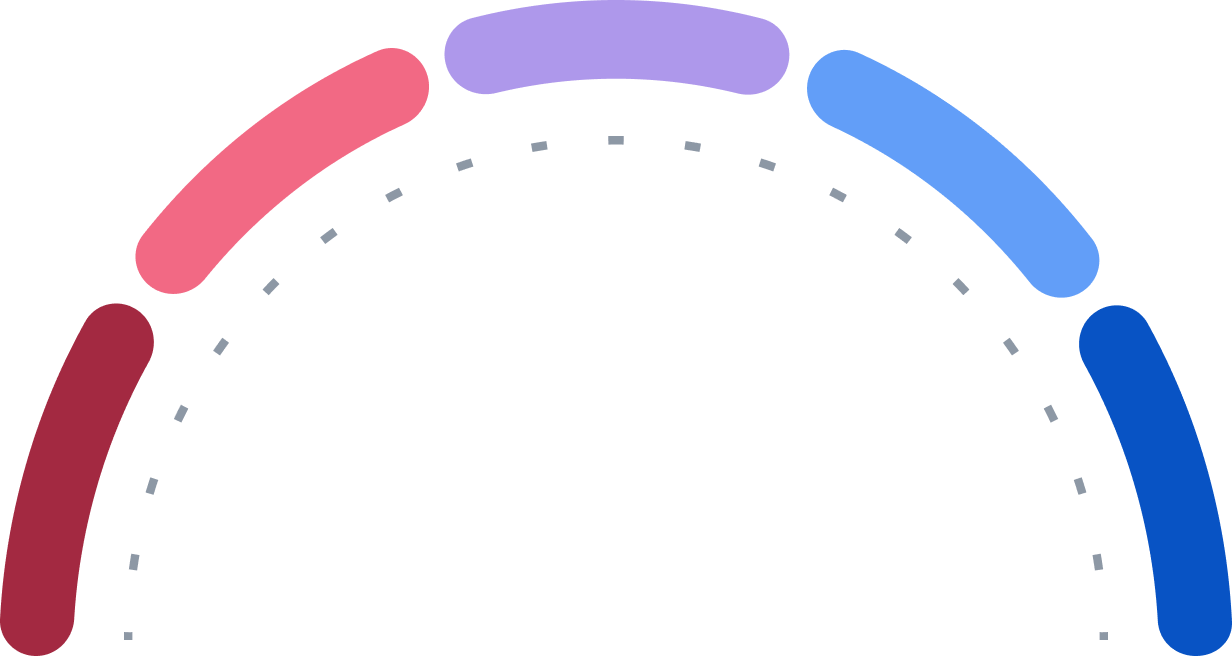

Halten

Starker Kauf

Kaufen

Halten

Verkaufen

Starker Verkauf

0

8

17

5

0

| Börse | Ticker | Währung | Letzter Umsatz | Kurs | Tagesveränderung |

|---|---|---|---|---|---|

NYSE |

WRB

|

USD

|

30.01.2026 23:56

|

69,12 USD

| 0,86 USD

+1,26 %

|

London |

0HMZ.L

|

USD

|

30.01.2026 15:43

|

68,37 USD

| 0,11 USD

+0,16 %

|

Frankfurt |

WR1.F

|

EUR

|

30.01.2026 07:12

|

56,80 EUR

| 0,78 EUR

+1,39 %

|

Quotrix |

BWRCRS29.DUSD

|

EUR

|

30.01.2026 06:27

|

56,88 EUR

| 0,86 EUR

+1,54 %

|

Düsseldorf |

BWRCRS29.DUSB

|

EUR

|

29.01.2026 18:30

|

56,66 EUR

| 1,00 EUR

+1,80 %

|

Hamburg |

BWRCRS29.HAMB

|

EUR

|

29.01.2026 07:10

|

56,30 EUR

| 0,64 EUR

+1,15 %

|

Folgende Fonds haben in BERKLEY CORP investiert:

Fonds | Vol. in Mio 6,69 | Anteil (%) 0,13 % |

Fonds | Vol. in Mio 3,57 | Anteil (%) 0,06 % |

Fonds | Vol. in Mio 3,26 | Anteil (%) 0,06 % |

Fonds | Vol. in Mio 106,56 | Anteil (%) 0,03 % |

Fonds | Vol. in Mio 1.099,55 | Anteil (%) 0,03 % |

NYSE

NYSE

| Ex-Datum | Dividende pro Aktie |

|---|---|

| 15.12.2025 | 1,09 USD |

| 22.09.2025 | 0,09 USD |

| 23.06.2025 | 0,59 USD |

| 03.03.2025 | 0,08 USD |

| 16.12.2024 | 0,58 USD |

| 23.09.2024 | 0,33 USD |

| 24.06.2024 | 0,93 USD |

| 01.03.2024 | 0,11 USD |

| 15.12.2023 | 0,61 USD |

| 22.09.2023 | 0,61 USD |

| Datum | Split |

|---|---|

| 11.07.2024 | 1.5:1 |

| 11.07.2024 | 3:2 |

| 24.03.2022 | 3:2 |

| 03.04.2019 | 3:2 |

| 12.03.2019 | 1:1 |

| 05.04.2006 | 3:2 |

| 11.04.2005 | 3:2 |

| 28.08.2003 | 3:2 |

| 19.09.1997 | 3:2 |

| 06.05.1991 | 3:2 |

| 19.06.1986 | 3:2 |

| 20.06.1983 | 107:100 |

| 21.06.1982 | 107:100 |

| 26.06.1981 | 107:100 |

| 26.06.1980 | 107:100 |

| 26.12.1979 | 107:100 |

| 26.06.1979 | 107:100 |

| 15.06.1978 | 106:100 |

| 06.06.1977 | 106:100 |

| 07.06.1976 | 106:100 |

| 27.05.1975 | 106:100 |

| Datum | Von | Zu |

|---|---|---|

| 01.05.2008 | BER | WRB |

| Name | Symbol |

|---|---|

| Düsseldorf | BWRCRS29.DUSB |

| Frankfurt | WR1.F |

| Hamburg | BWRCRS29.HAMB |

| London | 0HMZ.L |

| NYSE | WRB |

| Quotrix | BWRCRS29.DUSD |